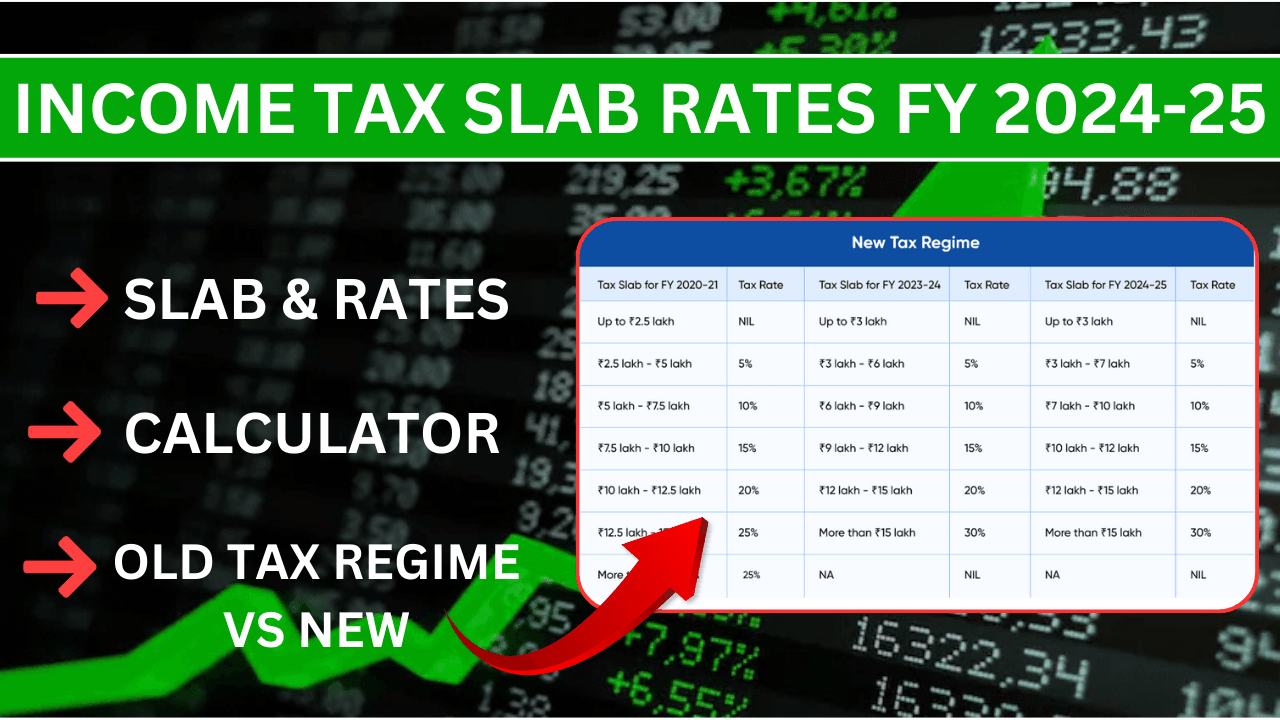

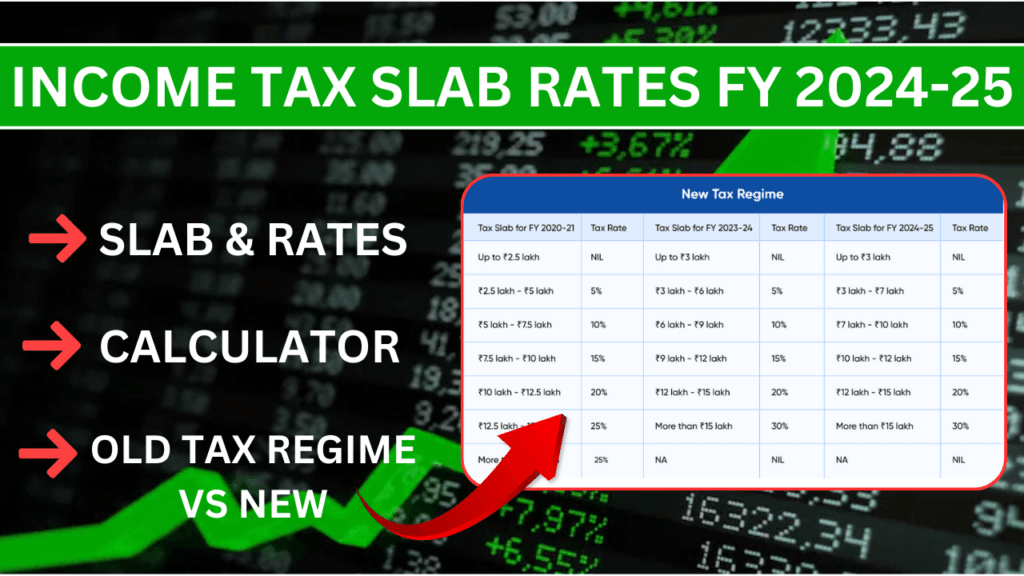

In India, income tax is calculated based on the applicable income tax slabs and rates for a given financial year (FY) and assessment year (AY). For FY 2024-25, the corresponding AY will be 2025-26. Let’s dive into the details of the tax regime changes, slab rates, and key announcements for this fiscal year.

New Tax Regime as Default in FY 2024-25

As per Budget 2024, the New Tax Regime will be considered the default unless taxpayers actively opt for the Old Tax Regime. However, individuals and businesses retain the freedom to choose between both regimes, depending on what benefits them the most.

Income Tax Slabs for FY 2024-25

Under India’s progressive tax structure, income is taxed based on slabs. Higher income levels correspond to higher tax rates, ensuring an equitable tax system.

Note: No changes have been made to the income tax slabs for FY 2024-25 compared to FY 2023-24. However, enhancements in deductions and benefits were introduced in Budget 2024, which can impact tax calculations.

New Tax Regime Slabs for FY 2024-25 (AY 2025-26)

| Annual Income (₹) | Tax Rate |

|---|---|

| Up to ₹3,00,000 | Nil |

| ₹3,00,001 to ₹7,00,000 | 5% |

| ₹7,00,001 to ₹10,00,000 | 10% |

| ₹10,00,001 to ₹12,00,000 | 15% |

| ₹12,00,001 to ₹15,00,000 | 20% |

| Above ₹15,00,000 | 30% |

Changes Announced in Budget 2024

- Tax Savings for Salaried Individuals:

- The standard deduction under the New Tax Regime has been increased from ₹50,000 to ₹75,000 for salaried employees.

- Family pension deduction has been raised from ₹15,000 to ₹25,000.

- NPS Employer Contribution Limit:

- For employees, the limit for employers’ contributions to the National Pension System (NPS) has been increased from 10% to 14% of salary.

- Introduction of NPS-Vatsalya:

- A new NPS-Vatsalya scheme for contributions by parents/guardians for minors was introduced. Upon reaching adulthood, the account can be converted into a standard NPS account.

👉 5 Major EPF Changes in 2025 That Every EPFO Members Must Know

Old Tax Regime Slabs for FY 2024-25 (AY 2025-26)

| Taxpayer Category | Income Range (₹) | Tax Rate |

|---|---|---|

| Individual (Below 60 Years) | Up to ₹2,50,000 | Nil |

| ₹2,50,001 to ₹5,00,000 | 5% | |

| ₹5,00,001 to ₹10,00,000 | 20% | |

| Above ₹10,00,000 | 30% | |

| Senior Citizen (60 to 80 Years) | Up to ₹3,00,000 | Nil |

| ₹3,00,001 to ₹5,00,000 | 5% | |

| ₹5,00,001 to ₹10,00,000 | 20% | |

| Above ₹10,00,000 | 30% | |

| Super Senior Citizen (80+ Years) | Up to ₹5,00,000 | Nil |

| ₹5,00,001 to ₹10,00,000 | 20% | |

| Above ₹10,00,000 | 30% |

Tax Rates for Domestic Companies (FY 2024-25)

| Category | Tax Rate |

|---|---|

| Companies registered after October 1, 2019, under Section 115BAB | 15% |

| Companies under Section 115BAA (without specified deductions) | 22% |

| Companies under Section 115BA (engaged in manufacturing post-March 1, 2016) | 25% |

| Turnover below ₹400 crores (previous year) | 25% |

| Other domestic companies | 30% |

Surcharge for Companies:

- 7% of income tax for total income above ₹1 crore but less than ₹10 crore

- 12% of income tax for total income exceeding ₹10 crore

Health & Education Cess: Applicable at a rate of 4% on tax plus surcharge.

Partnership Firms and LLPs

Both partnership firms and LLPs are taxed at 30%.

- A Surcharge of 12% applies if income exceeds ₹1 crore.

- Health and Education Cess: 4% on tax plus surcharge.

Comparing Old vs New Tax Regimes

Choosing between the old and new tax regimes depends on your financial habits and the deductions you claim. The New Tax Regime benefits taxpayers who do not heavily invest in tax-saving instruments, offering simplified slabs and reduced tax rates. On the other hand, the Old Tax Regime remains favorable for those who maximize exemptions and deductions.

Key Points for Consideration

- Higher Standard Deduction in New Regime: ₹75,000 (increased from ₹50,000).

- New Rebate u/s 87A for Income up to ₹7,00,000: No tax liability.

- Reduced Surcharge: The highest surcharge of 37% was reduced to 25% in Budget 2023.

How to Calculate Tax Using Slabs

Example (Old Regime):

Let’s assume Rohit has a taxable income of ₹8,00,000.

| Income Slab | Tax Rate | Tax Amount |

|---|---|---|

| Up to ₹2,50,000 | Nil | ₹0 |

| ₹2,50,001 to ₹5,00,000 | 5% | ₹12,500 |

| ₹5,00,001 to ₹8,00,000 | 20% | ₹60,000 |

| Total Tax | ₹72,500 | |

| Cess (4%) | ₹2,900 | |

| Total Tax Payable | ₹75,400 |

Deductions and Exemptions Under the New Tax Regime

Under the New Tax Regime, most deductions under Chapter VI-A (like Section 80C, 80D) and popular exemptions like HRA and LTA are not allowed. However, a few deductions remain eligible:

- Employer’s Contribution to NPS (Section 80CCD(2))

- Transport Allowance for Specially-abled Individuals

- Standard Deduction for Pensioners and Salaried Individuals

- Deduction for Employment of New Employees (Section 80JJAA)

Which Tax Regime Should You Choose?

The decision between Old vs New Tax Regime depends on your financial planning and investment strategy. Evaluate both options thoroughly and use the official Income Tax Calculator to estimate your liabilities before filing your tax return.

Deepak Verma is a graduate from Delhi University with a First Division. With 8 years of teaching experience in Mathematics and Science, he has mentored secondary and senior secondary students. Currently, he is an author at SAMSA, where he applies his expertise to create engaging educational content.