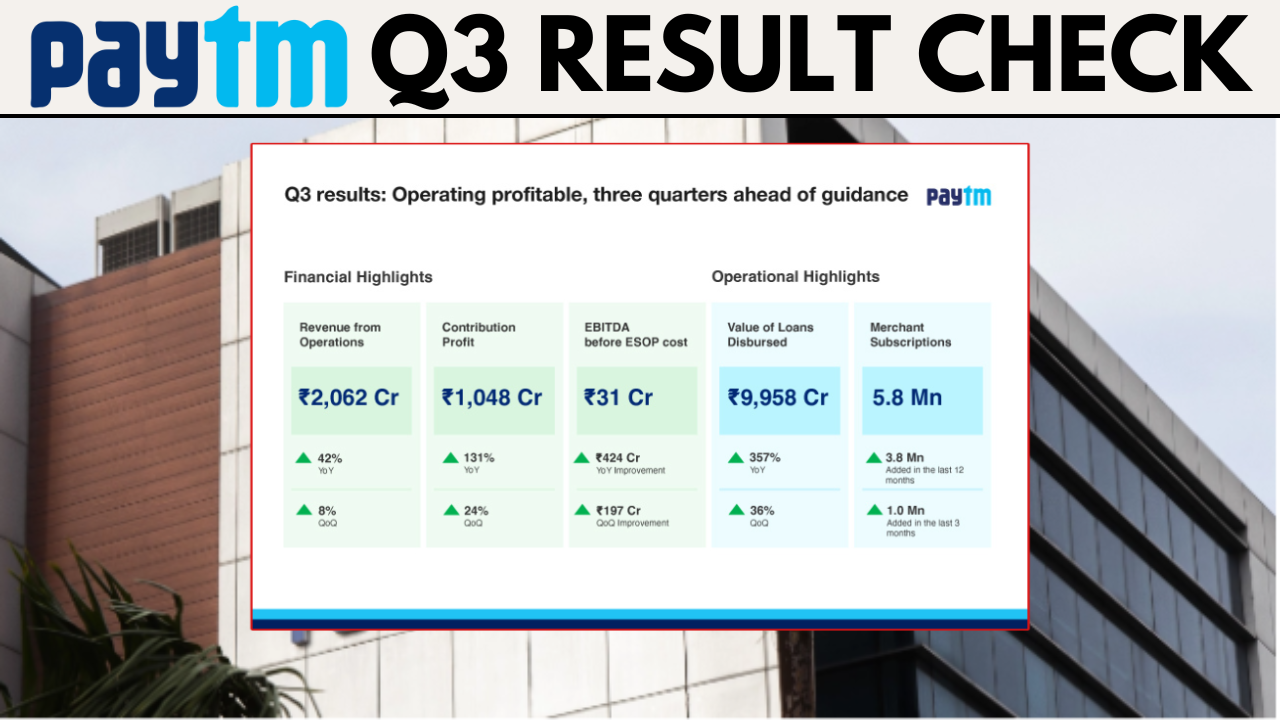

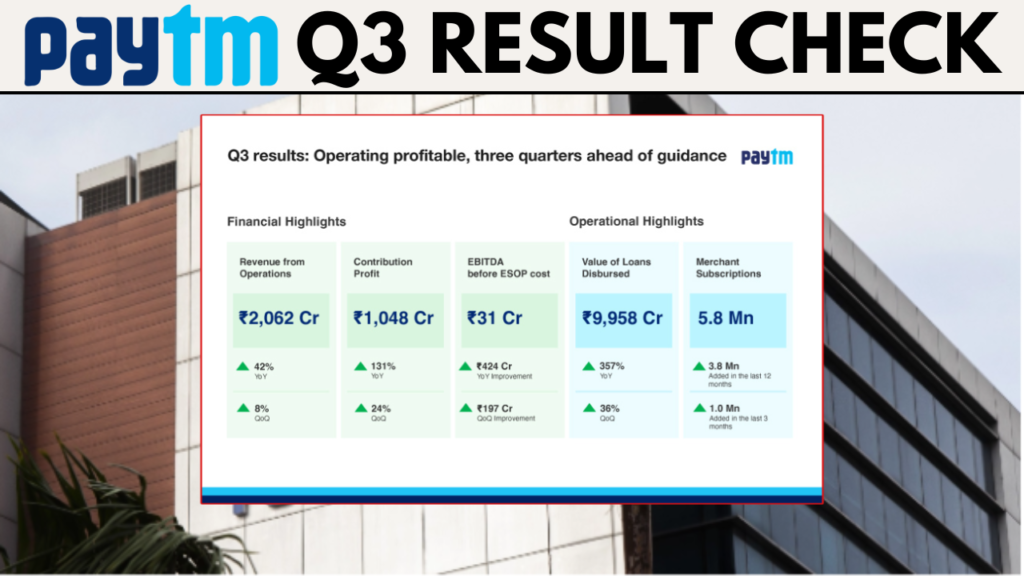

One 97 Communications, the parent company of fintech leader Paytm, has reported its financial results for the third quarter of FY25. The company’s performance reflects a reduction in net losses, improved operational efficiency, and growth in financial services revenue. Despite a significant year-on-year (YoY) drop in overall revenue, Paytm’s sequential revenue rose 10%, driven by growth in GMV (Gross Merchandise Value), subscription revenues, and financial services distribution.

Highlights of Paytm Q3 FY25 Results

| Metric | Q3 FY25 | Q3 FY24 | YoY Change | QoQ Change |

|---|---|---|---|---|

| Net Loss | ₹208.3 crore | ₹219.8 crore | 5.2% improvement | – |

| Consolidated Revenue | ₹1,827.8 crore | ₹2,850.5 crore | -36% | +10% |

| GMV (Gross Merchandise Value) | ₹5 lakh crore | – | – | +13% |

| Payment Services Revenue | ₹1,059 crore | – | – | +8% |

| Financial Services Revenue | ₹502 crore | – | – | +34% |

| Net Payment Margin | ₹489 crore | – | – | +5% |

| Average MTU (Monthly Transacting Users) | 7.0 crore | 7.1 crore | – | Decreased from 7.1 crore |

Revenue Performance

Paytm’s consolidated revenue from operations for Q3FY25 was ₹1,827.8 crore, a 36% decline YoY from ₹2,850.5 crore in Q3FY24. However, on a quarter-on-quarter (QoQ) basis, revenue increased by 10%, driven by:

- Higher GMV, which grew 13% QoQ to ₹5 lakh crore.

- Subscription revenue growth.

- Increased revenues from the distribution of financial services, reflecting Paytm’s growing focus on its lending and financial products.

Lower Expenses Helped Narrow Losses

Paytm’s total expenses reduced significantly, contributing to lower losses in Q3FY25. The company reported a net loss of ₹208.3 crore, an improvement from the ₹219.8 crore loss in Q3FY24.

- Total expenses fell 31% YoY to ₹2,219 crore, down from ₹3,216 crore.

- Payment processing charges decreased by 41.9%, saving ₹411.8 crore compared to last year.

- Employee benefit expenses dropped by 39.7%, contributing an additional ₹470.9 crore in cost savings.

The improvement in expense management reflects Paytm’s continued effort to optimize operational efficiency and control costs, particularly after shutting down its payments bank unit operations earlier in the year.

Breakdown of PaytmRevenue Streams

| Revenue Segment | Q3FY25 (₹ Crore) | QoQ Growth |

|---|---|---|

| Payment Services | ₹1,059 | 8% |

| Financial Services | ₹502 | 34% |

| Marketing Services | ₹267 | – |

Paytm’s financial services revenue rose 34% QoQ, driven by:

- A higher share of merchant loans disbursed.

- Better collection efficiency and higher trail revenue from the Default Loss Guarantee (DLG) portfolio.

- Growth in loan disbursement volumes, with ₹3,831 crore in merchant loans and ₹1,746 crore in personal loans distributed during the quarter.

Improved Cash Reserves Post PayPay Sale

One of the most notable financial improvements was Paytm’s cash balance, which jumped to ₹12,850 crore, up from ₹9,999 crore in the previous quarter. This boost came after the completion of Paytm’s sale of stock acquisition rights in Japan’s PayPay Corporation for $280 million (₹2,372 crore). The gain of ₹388 crore from this transaction contributed to a stronger balance sheet.

PAYTM Latest Updates on Quarter 3 Result

- Merchant Subscriptions Growth:

- Paytm increased its merchant subscription base to 1.17 crore, adding 5 lakh merchants QoQ.

- Revenue per merchant increased due to redeployment of inactive devices.

- Monthly Transacting Users (MTU):

- Average MTU was 7.0 crore in Q3FY25, slightly down from 7.1 crore in Q2FY25.

- However, the MTU exit run rate in December 2024 improved to 7.2 crore, following the Reserve Bank of India’s approval to onboard new UPI customers.

- Digital Lending Growth:

- Paytm continued to scale its DLG model for merchant and personal loans, attracting more lender partnerships.

- The DLG portfolio’s outstanding assets under management (AUM) rose to ₹4,244 crore, a sharp increase from ₹1,651 crore in September 2024.

Corporate Restructuring

As part of its efforts to streamline operations, Paytm:

- Completed the sale of Xceed IT Solutions, a subsidiary of Mobiquest Mobile Technologies, which had remained inactive since FY23.

- Paytm Cloud announced plans to establish subsidiaries in the UAE, Saudi Arabia, and Singapore, aiming to expand its services stack in international markets.

Current Perfomance of Paytm’s Shares

Following the announcement of its Q3 results, Paytm’s shares traded 2.5% lower at ₹880 apiece on the BSE as of 10:40 AM, January 20, 2025. Later in the day, the stock recovered slightly, trading at ₹902.85, up by 0.36%.

Deepak Verma is a graduate from Delhi University with a First Division. With 8 years of teaching experience in Mathematics and Science, he has mentored secondary and senior secondary students. Currently, he is an author at SAMSA, where he applies his expertise to create engaging educational content.